Introduction

Retiring to the sunny state of Florida is a dream for many seniors seeking warm weather, beautiful landscapes, and a vibrant retirement community. However, moving to Florida in your golden years also calls for careful estate planning to ensure a smooth transition and a secure future for yourself and your loved ones. In this article, we will explore the essential aspects of estate planning tailored specifically for retirees relocating to Florida.

Understanding the Importance of Estate Planning

Estate planning is a vital step for everyone, but it becomes even more crucial when you are a retiree moving to a new state like Florida. Proper estate planning helps you protect your assets, ensure your wishes are carried out, and minimize tax implications. Let’s delve into the key elements of estate planning for Florida-bound retirees.

Update Your Will and Trust

One of the first steps in estate planning for retirees moving to Florida is to update your will and trust documents. Florida has specific laws governing wills and trusts, so it’s essential to ensure your estate planning documents comply with state regulations. Consulting an experienced estate planning attorney is advisable to help you navigate these complexities and ensure your assets are distributed according to your wishes.

Consider Homestead Exemption

Florida offers a generous homestead exemption, which can significantly reduce property taxes for homeowners. As a retiree, this exemption can be highly beneficial if you plan to purchase a primary residence in the state. An estate planning attorney can help you maximize these tax advantages and integrate them into your overall estate plan.

Address Health Care and Long-Term Care

Healthcare decisions are a crucial part of estate planning, especially as you age. Designating a healthcare surrogate and establishing advance directives like a living will and durable power of attorney for healthcare can ensure that your medical wishes are honored. Additionally, consider long-term care planning, including Medicaid eligibility, to protect your assets while receiving the care you may need in the future.

Minimize Estate Taxes

Florida does not have a state estate tax, which can be advantageous for retirees. However, federal estate tax may still apply to larger estates. Consult with an estate planning attorney to explore strategies for minimizing estate taxes, such as gifting, establishing irrevocable trusts, and utilizing the marital deduction.

Update Beneficiary Designations

Retirees often have various accounts and insurance policies with beneficiary designations. Ensure that these designations align with your current wishes, especially if you have named family members who may live out of state. Updating beneficiary designations is a straightforward but critical aspect of estate planning.

Update Agent Appointments

Florida restricts who can act in certain capacities. For instance, a guardian or personal representative must be either a Florida resident or a relative. These appointments should be reviewed by a Florida estate planning attorney to ensure they conform to Florida Law.

Conclusion

Retiring to Florida is a dream come true for many, but it also presents unique estate planning challenges. By taking proactive steps and consulting with a knowledgeable estate planning attorney, you can ensure that your assets are protected, your wishes are upheld, and your transition to the Sunshine State is as smooth as possible. Remember that estate planning is a dynamic process that should evolve with your life circumstances, so periodic reviews with your attorney are essential to keep your plan up to date.

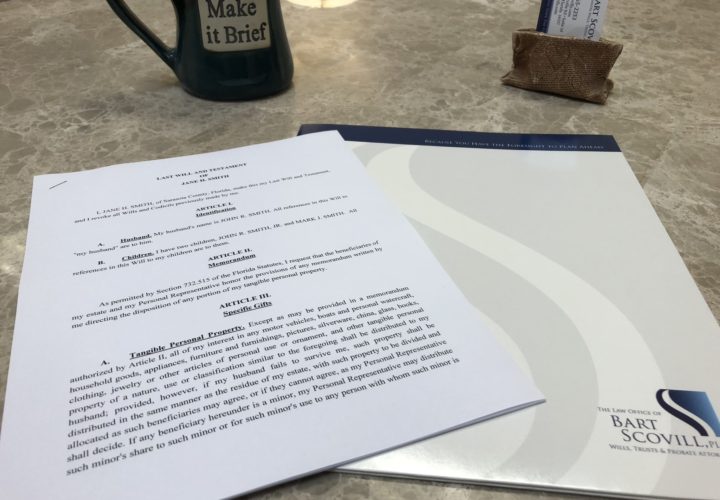

Contact Bart Scovill, PLC for Experienced Estate Planning Assistance in Florida

At Bart Scovill, PLC, we have 30 years of experience in helping retirees and newcomers to Florida navigate the complexities of estate planning in the state. We are here to provide personalized guidance and create a comprehensive estate plan tailored to your unique needs. Contact us today to schedule a consultation and start securing your future in the beautiful state of Florida.