Introduction

Estate planning is a crucial aspect of securing your family’s future, especially when dealing with complex situations like having an incapacitated spouse. In the state of Florida, navigating this process can be challenging, but with the right knowledge and guidance, you can ensure that your spouse’s interests are protected. This article will provide valuable insights and guidance on how to estate plan effectively when your spouse is incapacitated in Florida.

Understanding Incapacity

Before delving into estate planning strategies, it’s essential to understand what incapacity means in a legal context. In Florida, incapacity is typically determined when an individual is unable to manage their financial affairs or make informed decisions due to a physical or mental condition. This could result from an accident, illness, or cognitive decline.

- Establish Power of Attorney

The first step in estate planning with an incapacitated spouse is to establish a durable power of attorney (POA). A durable POA allows you to designate someone, often a trusted family member or friend, as your spouse’s attorney-in-fact. This person will have the legal authority to make financial and legal decisions on behalf of your incapacitated spouse. Additionally, if authorized, a power of attorney can allow for the establishment or modification of estate planning documents, which can assist if your spouse later becomes incapacitated. Consult with an experienced estate planning attorney to draft this document accurately.

- Create a Living Will and Healthcare Surrogate

In Florida, a living will and healthcare surrogate designation are crucial components of an estate plan for an incapacitated spouse. A living will outlines your spouse’s preferences for medical treatment and end-of-life decisions, ensuring their wishes are respected. Appointing a healthcare surrogate allows someone to make healthcare decisions on their behalf, ensuring proper medical care during incapacity.

- Trusts and Guardianship

Establishing a trust can be an effective way to manage assets and provide for your incapacitated spouse’s needs. A revocable living trust, for example, can allow for the seamless transfer of assets and financial management. If a trust is not established, a guardianship may be necessary, which involves the court appointing a guardian to manage your spouse’s affairs. This process can be time-consuming and costly, making a trust a preferred option.

- Update Beneficiary Designations

Review and update beneficiary designations on life insurance policies, retirement accounts, and other financial assets. Ensure that the named beneficiaries align with your estate planning goals and that the incapacitated spouse’s interests are protected.

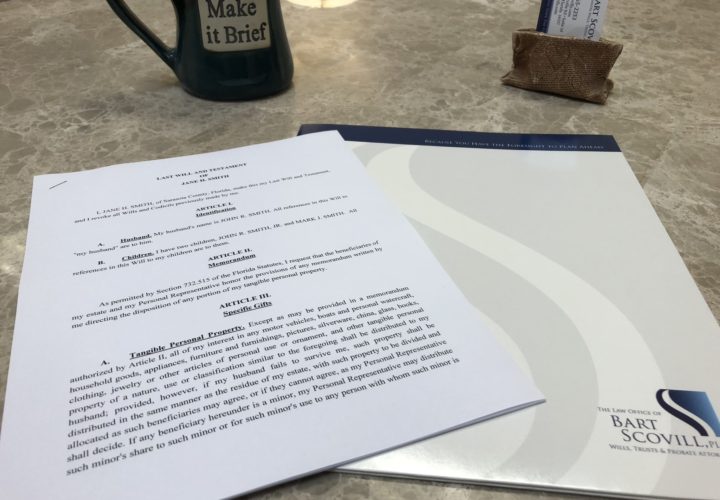

- Consult with an Experienced Estate Planning Attorney

Estate planning, especially when dealing with an incapacitated spouse, can be complex. Consulting with a knowledgeable Florida estate planning attorney is essential to navigate the legal intricacies, ensure compliance with state laws, and customize a plan that meets your specific needs.

- Regularly Review and Update the Estate Plan

Life circumstances change, and it’s vital to regularly review and update your estate plan to reflect these changes. Be proactive in ensuring that your plan continues to align with your spouse’s needs and your family’s goals.

Conclusion

Estate planning with an incapacitated spouse in Florida requires careful consideration, legal expertise, and a comprehensive approach. By establishing power of attorney, creating living wills, trusts, and consulting with experienced professionals, you can protect your spouse’s interests and secure your family’s future. Don’t wait until it’s too late – start your estate planning journey today to provide peace of mind for you and your loved ones.