Trust Administration in Florida

When someone passes away with a trust, the successor trustee must manage and distribute the trust assets according to the trust’s terms and Florida law. This process is called trust administration.

While a trust can often avoid probate, administering a trust still involves important legal and financial responsibilities. A mistake by the trustee can lead to disputes, tax issues, or personal liability.

Responsibilities of a Trustee

Depending on the trust terms and the nature of the assets, a trustee’s duties may include:

- Reviewing and understanding the trust document.

- Identifying, protecting, and valuing trust assets.

- Notifying beneficiaries and providing required accountings.

- Paying debts, taxes, and expenses from trust assets.

- Distributing property to beneficiaries as directed in the trust.

- Maintaining accurate records of all trust transactions.

Why Legal Guidance Matters

Florida law holds trustees to a fiduciary duty, meaning they must act in the best interest of the beneficiaries and follow the trust exactly. Even well-meaning trustees can make costly mistakes without proper guidance, such as:

- Distributing assets too early.

- Failing to account for taxes.

- Overlooking creditor claims.

- Misinterpreting trust language.

Having experienced legal assistance can help ensure the process is done correctly and efficiently.

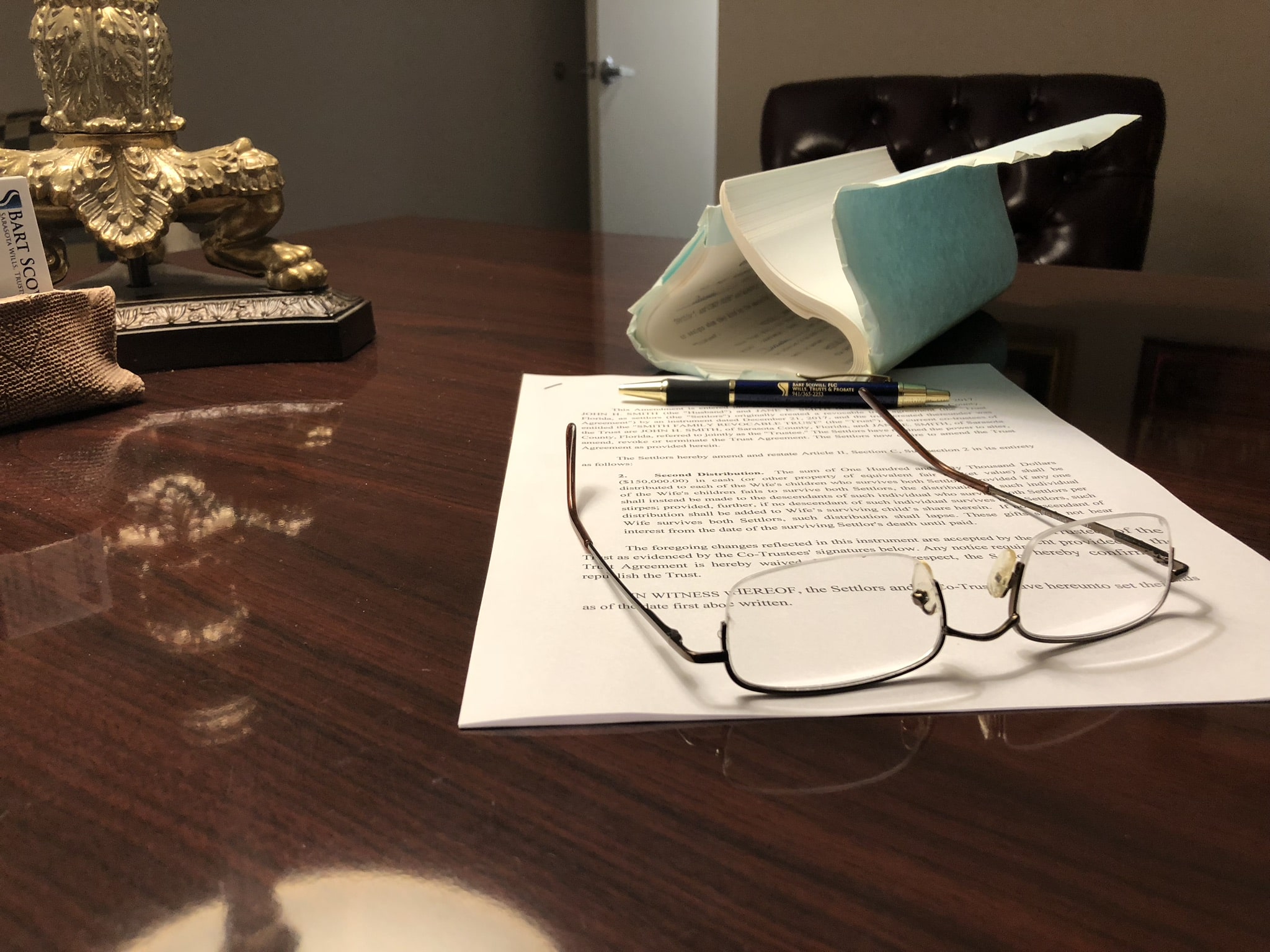

How We Can Help

At Bart Scovill, PLC, we assist trustees and beneficiaries with every stage of trust administration, including:

- Explaining trustee responsibilities and timelines.

- Helping gather and safeguard trust assets.

- Preparing and sending required notices to beneficiaries.

- Handling creditor claims and tax matters.

- Guiding the distribution of assets to avoid disputes.

We also work with trustees who live outside of Florida but must administer a Florida-based trust.

Contact Bart Scovill, PLC at 941-365-2253 or use our online contact form for assistance with Florida trust administration.