Estate Planning

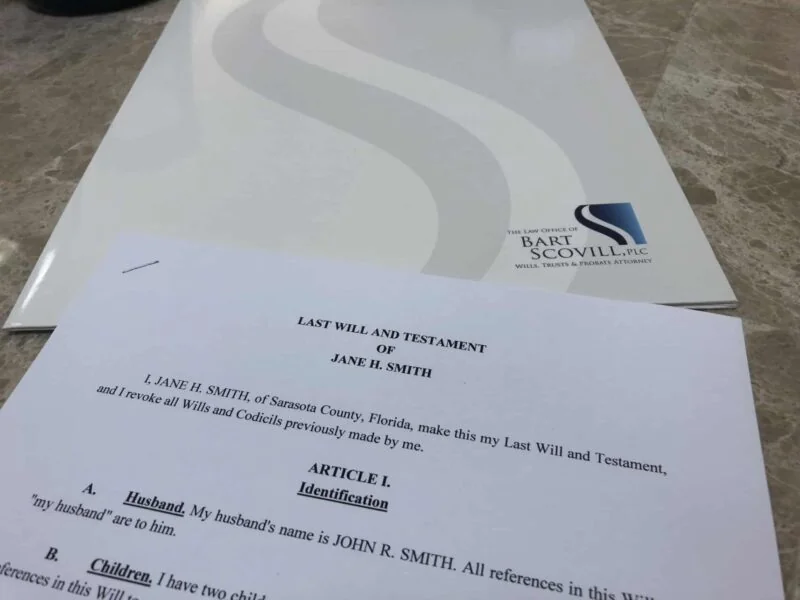

A thorough Estate Plan should consist of both testamentary documents like Wills & Trusts directing the transfer of your assets and Advance Directives to protect you during your lifetime.

Testamentary Documents

Advance Directives

Special

Latest Articles

Contact Us For More Information

Or Call 941-365-2253 for a Free Consultation

NOTE: The use of the Internet or this form for communication with the firm does not establish an attorney-client relationship. Confidential or time-sensitive information should not be sent through this form.