What Is a Pour-Over Will and Why Might You Need One in Florida?

When creating a living trust, many clients assume their estate plan is complete. But without one key document, a pour-over will, important assets may be left exposed to probate or legal confusion. If you’ve established a trust in Florida or are considering one, understanding how a pour-over will fits into your estate plan is essential.

In this article, we’ll break down what a pour-over will is, how it works in conjunction with a living trust, and why it may be the missing piece in your estate plan.

What Is a Pour-Over Will?

A pour-over will is a special type of last will and testament that works hand-in-hand with your revocable living trust. Its primary purpose is to “catch” any assets you didn’t transfer into your trust during your lifetime and direct them into it upon your death.

In other words:

- It “pours over” any remaining property into your trust.

- It ensures your trust ultimately controls the distribution of all your assets.

- It helps protect property that may have been unintentionally left out of the trust.

Without this legal safeguard, any unassigned assets could pass through Florida probate under default laws, not your instructions.

Related Resource: Last Will and Testament in Florida →

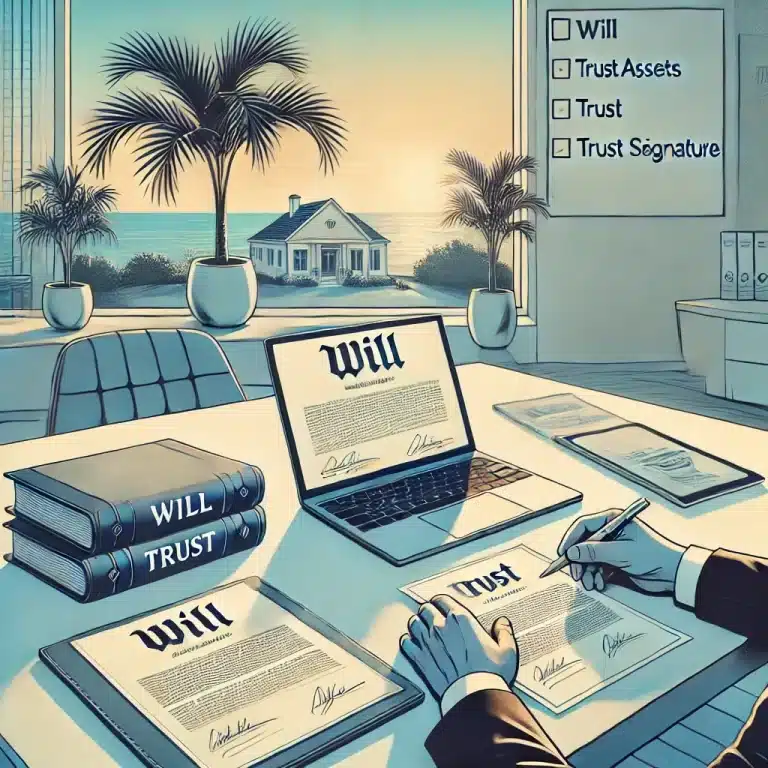

Why Many Trusts Are Incomplete Without a Pour-Over Will

Even the most organized individuals can forget to transfer assets into their trust, or they may acquire new property without updating their documents. A pour-over will acts as a safety net, preventing those assets from being distributed contrary to your wishes.

Common Scenarios That Trigger a Pour-Over Will:

- A newly purchased car or property wasn’t titled in the trust’s name.

- A savings account or digital asset was overlooked.

- Personal property (jewelry, artwork, collectibles) was never formally assigned.

Without a pour-over will, these assets would be handled through the probate court and distributed according to Florida’s intestacy laws, potentially leaving out intended beneficiaries.

How It Simplifies Post-Death Administration

One of the biggest advantages of using a pour-over will in Florida is how it streamlines the administration process after death.

Benefits Include:

- Unified management: All assets, including those not initially in the trust, are ultimately distributed per the trust’s instructions.

- Privacy: Although the pour-over will may go through probate, trust terms generally remain private unless disclosed during a legal dispute.

- Clarity for loved ones: Reduces confusion or disputes among heirs about who should receive what.

In short, a pour-over will makes it easier for your trustee and personal representative to follow your wishes, even if something was missed during your lifetime.

Pour-Over Wills and Florida Law

In Florida, pour-over wills are widely used by residents and out-of-state property owners who establish living trusts to avoid probate and simplify asset transfers. However, the state does not automatically assume your assets should transfer to your trust unless you document that intention clearly.

That’s why it’s vital to:

- Work with a qualified estate planning attorney in Sarasota or Venice

- Regularly review your trust and pour-over will

- Keep all documents updated after major life changes

Learn more about About Bart Scovill, PLC and approach to personalized estate planning in Florida.

FAQs: Pour-Over Wills in Florida

Q: If I have a living trust, do I really need a will?

A: Yes. A pour-over will acts as a legal safety net for any property not titled in the trust’s name.

Q: Does a pour-over will avoid probate?

A: Not entirely. Any assets it captures will pass through probate, but only temporarily, before being moved into the trust.

Q: Should I name the same person as Personal Representative (commonly called an executor in other states) and Trustee?

A: In many cases, yes. Having the same person (or team) manage both roles can streamline the process.

Final Thoughts

Even the best-crafted living trust can fall short if assets are left outside it. A pour-over will ensures your estate plan works cohesively and that no asset is left behind due to oversight or timing. It’s a critical tool for protecting your legacy and your loved ones.

Connect your estate plan with confidence, ask us about pour-over wills.

Schedule a consultation today →

Explore More

- Last Will and Testament in Florida

- About Estate Planning Service

- Office Near Sarasota: Contact for Appointment

This content is for general educational purposes only and does not constitute legal advice. For personalized guidance, consult with a licensed estate planning attorney in your jurisdiction.

Contact Us For More Information

Or Call 941-365-2253 for a Free Consultation

NOTE: The use of the Internet or this form for communication with the firm does not establish an attorney-client relationship. Confidential or time-sensitive information should not be sent through this form.