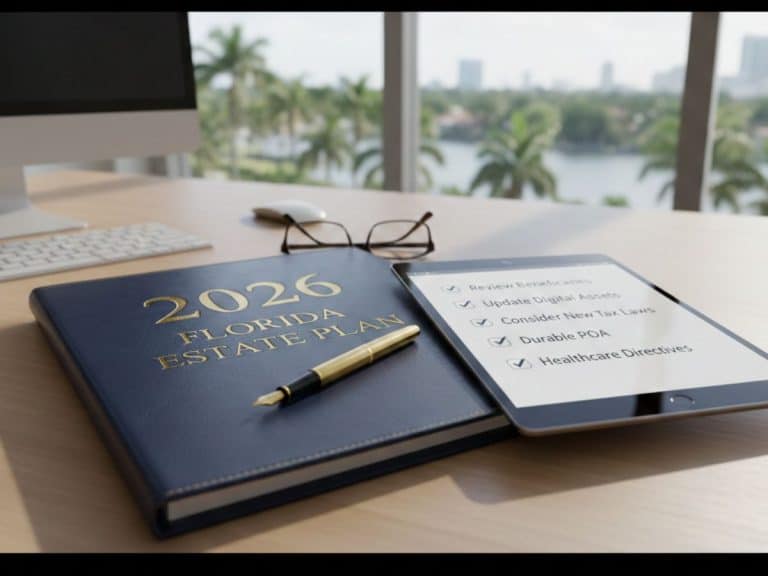

New Law for Florida Powers of Attorney

The Florida Statutes regarding Powers of Attorney were amended as of October of last year. While Powers of Attorney executed prior to this change remain in effect, there is a concern about the manner in which financial institutions will continue to honor older Powers of Attorney.

The Florida Statutes regarding Powers of Attorney were amended as of October of last year. While Powers of Attorney executed prior to this change remain in effect, there is a concern about the manner in which financial institutions will continue to honor older Powers of Attorney.• Powers may be granted to change estate planning documents (“Superpowers”)

• Unless provided otherwise, co-agents may act independently of each other

• Qualified agents are entitled to compensation

• Duties of an agent have been specifically enumerated

Contact Us For More Information

Or Call 941-365-2253 for a Free Consultation

NOTE: The use of the Internet or this form for communication with the firm does not establish an attorney-client relationship. Confidential or time-sensitive information should not be sent through this form.