Protecting Vacation Homes in Florida: How to Pass Down Second Properties

Florida vacation homes are often more than an investment; they’re places where family memories are made and traditions are built. But when it comes to passing down these second properties, too many families are caught off guard by legal and tax issues that could have been avoided.

In this article, we’ll walk through the key legal considerations for safeguarding your Florida vacation home for future generations. Whether you’re an out-of-state owner or a Florida resident, thoughtful planning today can save your loved ones from stress and financial complications later.

Unique Challenges of Inherited Vacation Homes

Passing down a second property, especially one located in another state, requires more than a simple will. Without the right legal structure, your family could face:

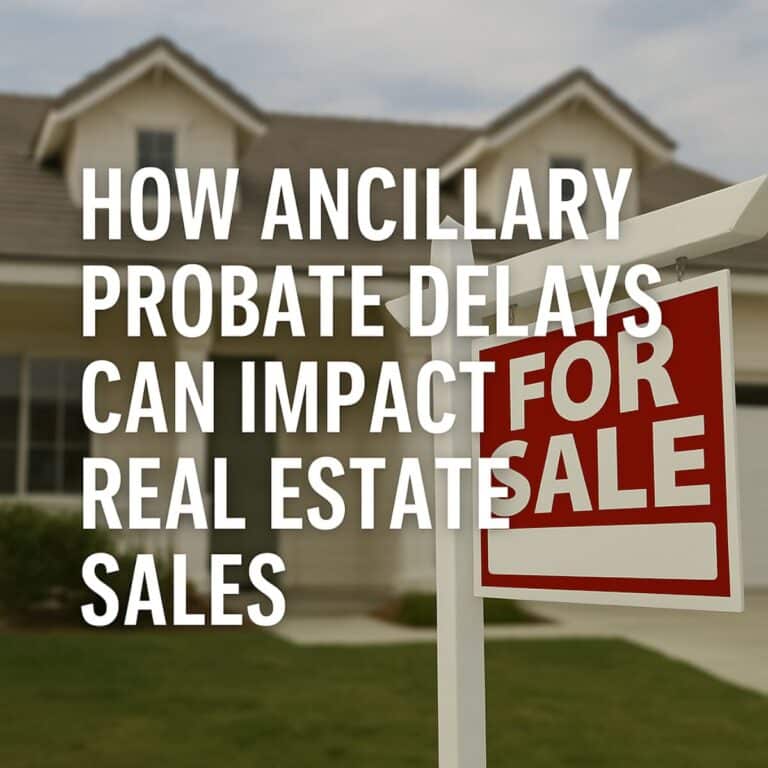

- Ancillary probate in Florida if the decedent lived in another state

- Disagreements among heirs on whether to keep, rent, or sell the home

- Costly delays in transferring ownership, affecting maintenance and taxes

Many out-of-state families are surprised to learn that a second home in Florida requires a separate probate process, unless the property is placed in a trust or deeded appropriately during the owner’s lifetime.

Related Resource: Florida Living Trust Services →

Gifting vs. Using a Trust: What’s Better?

There are two common approaches to passing down real estate: outright gifting or placing the home in a trust. Each has pros and cons, but trusts are often preferred for vacation homes.

Gifting the Property

- May reduce the size of your taxable estate

- Loss of control during your lifetime

- May trigger capital gains for your heirs

Placing the property in a properly funded trust can help:

- Avoid Florida probate entirely

- Allow you to retain control and designate successor beneficiaries

- Can include conditions (e.g., shared usage, restrictions on sale)

Placing the home in a revocable living trust ensures a smooth transition while maintaining flexibility. It’s especially useful if your heirs live in different states or have differing intentions for the property.

Tax & Maintenance Considerations

Inheriting a vacation home doesn’t just involve the deed; it also means inheriting the costs.

Be Mindful Of:

- Property taxes and reassessments upon transfer

- Homeowner’s insurance requirements, especially in hurricane zones

- HOA or condo fees, which may be non-transferable without new ownership

- Capital gains tax if the home is sold post-inheritance

Discussing these financial factors with your heirs, and outlining them in your estate plan can prevent resentment or confusion later.

Real-World Example: Why Planning Ahead Matters

A Sarasota client with two adult children placed her beachfront vacation home into a living trust. She included instructions allowing both children to use the home seasonally and established a maintenance fund within the trust. As a result, when she passed, the home transferred smoothly; no probate, no conflict, no delays.

This kind of planning can reduce the risk of disputes and delays.

FAQs: Passing Down a Florida Vacation Home

Do I need to be a Florida resident to create a trust for a Florida home?

No. Out-of-state individuals owning Florida property can often create Florida-based trusts, but should consult a licensed Florida attorney.

Can I restrict how my heirs use the home?

Yes. A trust allows you to include specific terms, such as rental use, upkeep responsibilities, or ownership buy-out rights.

What happens if I do nothing?

Without a plan, your vacation home may go through Florida probate, creating extra expense and legal headaches for your family.

Final Thoughts

Whether your Florida vacation home is a cozy beach bungalow or a luxury condo, proper estate planning ensures it remains a source of joy, not conflict, for your family.

Preserve your family’s getaway, get legal guidance on how to pass it on.

Schedule a consultation today →

Explore More Resources

Contact Us For More Information

Or Call 941-365-2253 for a Free Consultation

NOTE: The use of the Internet or this form for communication with the firm does not establish an attorney-client relationship. Confidential or time-sensitive information should not be sent through this form.