Planning for Peace of Mind: Estate Planning Considerations for Hurricane Season in Florida

Each year, Floridians prepare for hurricane season with practical steps like stocking up on supplies, securing property, and reviewing evacuation routes. But there’s another crucial task that should be part of your seasonal checklist: reviewing your estate plan. For residents in Venice and surrounding areas, taking time to update documents like powers of attorney and health care surrogates can provide legal security during one of the most unpredictable times of year.

This article explores why estate planning before hurricane season is essential, especially for Florida residents and out-of-state property owners who may be subject to ancillary probate in Florida.

Why Estate Planning Should Be Part of Your Hurricane Prep

Hurricane season officially begins on June 1st, and emergencies can arise quickly. In the event of evacuation, hospitalization, or property loss, having your estate planning documents in order ensures that critical financial and medical decisions can be made without delay or confusion.

Key Considerations:

- Incapacity: A storm-related injury or illness may leave you unable to make decisions. Powers of attorney and health care surrogate forms enable someone you trust to step in.

- Access to Records: If your home is damaged or you’re displaced, keeping digital and physical copies of legal documents in multiple locations (e.g., cloud storage, with your attorney, in a fireproof safe) is vital.

- Out-of-State Owners: Non-Florida residents who own Florida property face specific probate challenges. A storm that damages real estate could trigger legal proceedings, especially if ownership isn’t structured to avoid probate.

For residents in Venice, working with a local estate planning attorney ensures compliance with Florida-specific statutes and readiness for seasonal risks. Connect with Scovills to begin.

Legal Documents to Review Before Hurricane Season

1. Durable Power of Attorney

This document allows a trusted individual to manage your finances, pay bills, or handle insurance claims if you’re incapacitated.

Why it matters during hurricane season:

- Helps someone access accounts for emergency repairs

- Assists with insurance communications and claims

- Can ensure mortgage and utility bills are paid on time

Learn more about Powers of Attorney

2. Designation of Health Care Surrogate

This form appoints a person to make medical decisions if you’re unable to communicate with providers.

Storm-related situations where this applies:

- Medical treatment following an accident or evacuation

- Hospitalizations due to chronic conditions worsened by weather-related stress

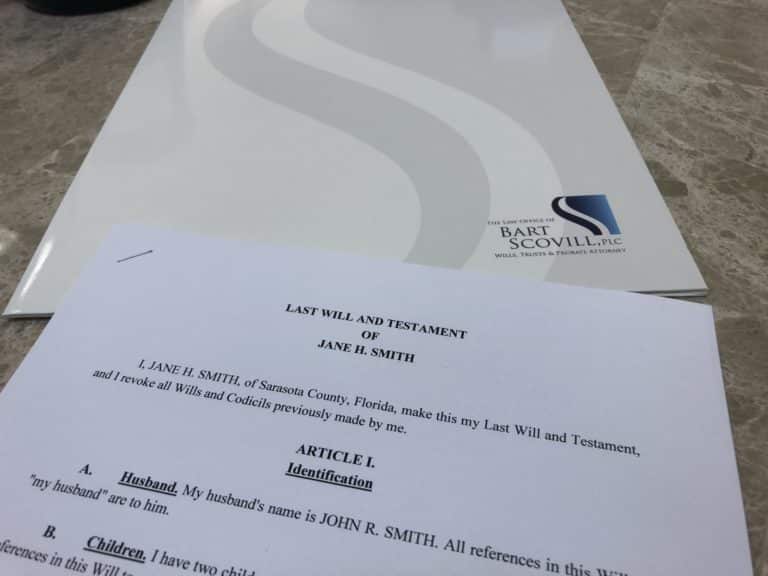

3. Updated Will or Living Trust

Ensure your will reflects your current assets, beneficiaries, and preferences. Consider using a living trust to protect property from probate.

During a natural disaster:

- A trust can expedite property distribution if something unexpected happens

- Wills and trusts provide guidance to loved ones in times of grief and chaos

Visit the Venice Wills, Trusts & Probate Attorney page for more information.

Understanding Ancillary Probate in Florida

If you own property in Florida but reside elsewhere, your estate may be subject to ancillary probate—a separate legal proceeding that applies when a non-resident passes away owning Florida real estate.

Why This Matters for Hurricane Season:

- Storm damage to a Florida home could result in a complicated insurance claim process

- If the property isn’t titled in a trust or with survivorship rights, probate delays can increase financial burdens on surviving family members

- Ancillary probate is governed by Florida law, regardless of where the decedent lived

Preventive Measures:

- Work with your primary and Florida-based attorney to align property titling

- Consider placing Florida real estate into a living trust to bypass probate

- Confirm beneficiary designations on accounts or deeds

To avoid common mistakes, consult a local estate planning attorney in Venice who understands both Florida probate law and seasonal risks unique to the region.

Steps to Update Your Estate Plan Before Storm Season

- Schedule a Legal Review: Ideally, with an attorney familiar with both estate and disaster planning

- Check Digital Access: Store your documents securely online (encrypted cloud storage)

- Confirm Contacts: Make sure your agents (POA, health surrogate) know their roles and have updated copies

- Secure Hard Copies: Place them in a waterproof/fireproof location at home, and with your attorney or trusted advisor

- Review Property Titles: Ensure real estate is titled correctly to avoid probate delays

- Update Emergency Contacts: Include your estate attorney’s information in your disaster kit

Frequently Asked Questions

Q: What happens if I lose my will in a storm?

A: If your will is not stored digitally or with your attorney, Florida law may treat your estate as if no will exists. Always keep backups.

Q: Does my health care surrogate form need to be notarized in Florida?

A: Yes. It must be signed by the principal and two witnesses, with at least one witness not being the surrogate. Notarization is recommended for clarity.

Q: How does ancillary probate work if I die out-of-state?

A: Florida courts require a separate proceeding for any Florida property owned by a non-resident. This process adds time and expense unless your assets are titled to avoid probate.

Key Takeaway

Estate planning is often seen as a long-term task, but hurricane season highlights its immediate importance. Reviewing and updating your estate documents before June 1st ensures that you, your family, and your property are legally protected, even in the face of uncertainty.

Whether you live in Venice year-round or own seasonal property, the experienced attorneys at Scovills are here to help. Schedule a consultation to prepare your estate plan before storm season starts.

Sources:

Contact Us For More Information

Or Call 941-365-2253 for a Free Consultation

NOTE: The use of the Internet or this form for communication with the firm does not establish an attorney-client relationship. Confidential or time-sensitive information should not be sent through this form.