Durable Power of Attorney in Florida

A Durable Power of Attorney (DPOA) is a legal document that allows you to give someone you trust—the agent or attorney-in-fact—the authority to handle your financial and legal matters. In Florida, a DPOA is “durable” because it remains effective even if you become incapacitated.

What a Durable Power of Attorney Can Do

The authority you give your agent can be broad or limited, depending on your needs. Common powers include:

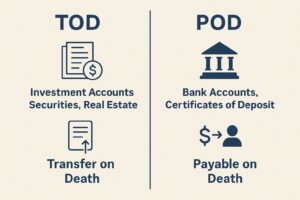

- Managing bank accounts and investments.

- Paying bills and handling taxes.

- Buying, selling, or managing real estate.

- Signing contracts and legal documents.

- Handling insurance and retirement accounts.

Florida law requires that certain powers—sometimes called “superpowers”—must be specifically initialed in the document to be valid, such as the ability to make gifts, change beneficiary designations, or create trusts.

Why It’s Important

Without a valid Durable Power of Attorney, your family may have to go through a guardianship proceeding if you become incapacitated, which can be costly, time-consuming, and stressful.

A DPOA allows someone you choose to act for you immediately, without waiting for court approval.

Limitations and Considerations

- The powers take effect immediately upon signing in Florida (springing powers are no longer allowed for new documents).

- You must choose an agent you trust completely, as they will have access to your finances and legal rights.

- Financial institutions may refuse older or out-of-date powers, so periodic reviews are recommended.

- A DPOA ends at your death and cannot be used after that time.

How We Can Help

At Bart Scovill, PLC, we:

- Draft Durable Powers of Attorney that comply with Florida’s strict statutory requirements.

- Explain each power so you understand exactly what your agent can and cannot do.

- Include or exclude “superpowers” based on your preferences and needs.

- Coordinate your DPOA with your overall estate plan.

Contact Bart Scovill, PLC at 941-365-2253 or use the contact form below to create or update your Durable Power of Attorney.