As we step into a new year, it’s a great time to reflect on our goals and make sure we are on track for a secure and organized future. One of the most important aspects of personal and financial security is estate planning. Estate planning involves preparing for the future by making decisions about how your assets will be managed and distributed after your death. It’s not just for the wealthy—it’s for anyone who wants to ensure that their loved ones are protected, their wishes are honored, and their assets are managed appropriately when the time comes.

If you haven’t reviewed or updated your estate plan in a while, now is the perfect time to do so. In this blog, we’ll discuss why starting the year by reviewing your estate plan is essential and offer tips on how to make sure your plan is up-to-date. Whether it’s updating your will, reviewing your powers of attorney, or revisiting your trust, taking a proactive approach to estate planning can save your family time, stress, and money in the future.

Why Start the Year with Estate Planning?

The start of a new year is a time when people typically set goals, make resolutions, and look ahead to the future. Estate planning is no different. As life changes, so do your needs and wishes. Reviewing or updating your estate plan at the beginning of each year can help ensure that it aligns with your current circumstances and goals. Whether it’s because of a change in family dynamics, new assets, or changes in tax laws, staying on top of your estate planning needs is crucial for peace of mind.

In addition, life events like marriage, divorce, the birth of a child, or the death of a loved one can have a significant impact on your estate plan. It’s important to reflect on these changes and make necessary adjustments to reflect your updated priorities.

1. Review Your Will

A will is one of the most essential documents in an estate plan. It outlines how you want your assets to be distributed after your death, who will be responsible for executing the will, and how your minor children will be cared for. A will can also specify your wishes for funeral arrangements and who will take charge of your pets.

Tips for Reviewing Your Will:

- Update Beneficiaries: Over the course of your life, circumstances change. Relationships shift, children grow older, or new family members join. It’s crucial to update your will regularly to reflect these changes. Make sure that the beneficiaries you’ve named still align with your wishes.

- Review Executor Appointment: The executor of your will is responsible for ensuring that your wishes are carried out. This person needs to be trustworthy and capable of handling the responsibilities involved in administering the estate. If your previous choice is no longer the right fit, consider appointing someone new.

- Clarify Your Wishes: If there have been any changes in how you want your assets distributed—such as making charitable donations or adding specific gifts to loved ones—now is the time to ensure those changes are captured in your will.

2. Evaluate Your Powers of Attorney

Powers of attorney are documents that appoint someone to make decisions on your behalf if you become incapacitated. There are two primary types: a financial power of attorney (to manage financial affairs) and a healthcare power of attorney (to make medical decisions). These documents are essential for ensuring that someone you trust can step in and manage your affairs if you are unable to do so.

Tips for Reviewing Your Powers of Attorney:

- Ensure They Are Up to Date: Powers of attorney must be created when you are mentally competent. If there have been any changes in your life, such as moving to a new state, or if the person you originally chose as your agent is no longer appropriate, you should review and update your powers of attorney.

- Choose Trusted Agents: Your chosen agent must be someone who understands your wishes and will act in your best interest. If your agent is no longer available or capable, appoint a new one. It’s essential to choose someone who is both trustworthy and capable of handling the responsibilities involved.

- Consider a Successor: It’s a good idea to name an alternative agent (a successor) in case your first choice is unable to act. This ensures there’s no gap in decision-making when it comes to your finances or healthcare.

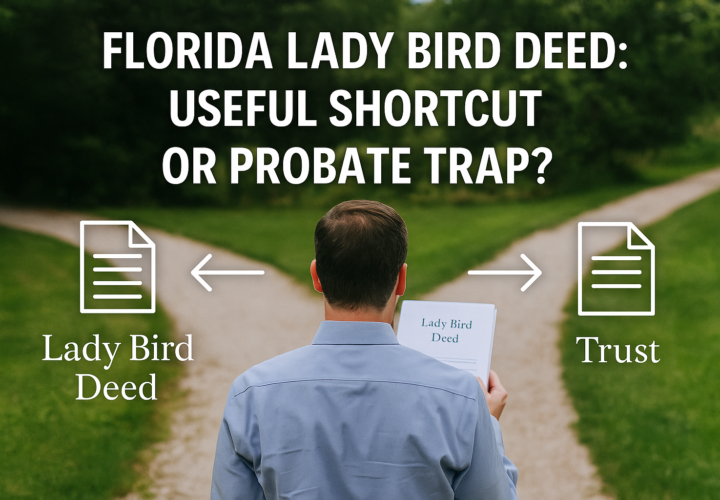

3. Review Your Trusts

A trust is a powerful estate planning tool that allows you to place assets in a fiduciary arrangement that will be managed for your benefit or the benefit of your beneficiaries. There are several different types of trusts, including revocable living trusts, irrevocable trusts, and special needs trusts, each serving different purposes.

Tips for Reviewing Your Trust:

- Make Sure Your Trust Is Properly Funded: One of the most important things to check when reviewing your trust is whether it has been properly funded. This means ensuring that your assets—such as real estate, bank accounts, and investments—are properly titled in the name of the trust. If you acquire new assets or open new accounts, be sure to transfer them into the trust.

- Review Trustee Appointments: Your trustee is responsible for managing the assets in your trust and distributing them according to the trust’s terms. Make sure that the person or institution you’ve appointed is still suitable and capable of handling this responsibility. If not, you may want to appoint a new trustee.

- Consider Tax Implications: Trusts can help reduce estate taxes and manage assets more efficiently, but tax laws change frequently. Be sure to consult with a qualified estate planning attorney to ensure that your trust is structured in a way that best protects your estate from unnecessary taxes.

4. Update Your Beneficiary Designations

Beneficiary designations are used to pass certain assets directly to individuals upon your death, bypassing the probate process. Common accounts with beneficiary designations include life insurance policies, retirement accounts (IRAs, 401(k)s), and payable-on-death (POD) accounts.

Tips for Reviewing Beneficiary Designations:

- Ensure Consistency with Your Will: Sometimes, people name beneficiaries for certain assets without updating their will or trust to reflect these choices. Ensure that the beneficiaries listed on all accounts align with the overall intentions of your estate plan.

- Update Designations After Life Changes: Life events such as marriage, divorce, or the birth of a child often require an update to your beneficiary designations. Be sure to update these details regularly to reflect your current family and financial situation.

- Consider Contingent Beneficiaries: In addition to naming a primary beneficiary, consider naming contingent beneficiaries (secondary beneficiaries) who will inherit your assets if the primary beneficiary is unable to do so.

5. Stay Informed on Tax Law Changes

Tax laws, especially estate taxes and gift taxes, can change over time. The start of the year is a great time to ensure that your estate plan is structured to take advantage of current tax laws and minimize potential tax liabilities.

Tips for Staying Informed:

- Consult a Tax Professional: Work with an estate planning attorney or tax advisor to ensure that your estate plan is tax-efficient. Changes in federal and state tax laws may impact your estate plan, and it’s important to adapt to these changes.

- Consider Lifetime Gifting: The new year is a good time to consider making gifts to loved ones while taking advantage of annual gifting limits, potentially reducing the size of your taxable estate.

6. Work with an Estate Planning Attorney

An estate planning attorney can provide invaluable guidance in creating or updating your estate plan. They can help ensure that your will, powers of attorney, trusts, and beneficiary designations are properly structured, legally sound, and aligned with your wishes.

If you’re in the Bradenton area, working with an experienced estate planning attorney will help ensure that your estate plan is both comprehensive and compliant with Florida laws.

For more information on estate planning services, visit Scovills Estate Planning.

Conclusion

The start of the year is the perfect time to take stock of your estate plan and ensure that it’s in good shape for the future. By reviewing or updating your will, powers of attorney, trusts, and beneficiary designations, you can provide peace of mind for yourself and your family. Regularly revisiting your estate plan helps ensure that it continues to reflect your current wishes, family dynamics, and financial situation.

If you haven’t reviewed your estate plan recently, now is the time to take action. Consult with a qualified Bradenton estate planning attorney to guide you through the process and ensure that your plan is up-to-date and well-structured for the year ahead. Let this year be the one where you take control of your legacy, ensuring that your loved ones are cared for and your wishes are honored.

For experienced guidance in estate planning, visit Scovills today!